Facts About Eb5 Immigrant Investor Program Uncovered

Table of ContentsUnknown Facts About Eb5 Immigrant Investor ProgramThe Only Guide for Eb5 Immigrant Investor ProgramWhat Does Eb5 Immigrant Investor Program Mean?The 6-Second Trick For Eb5 Immigrant Investor ProgramLittle Known Facts About Eb5 Immigrant Investor Program.Some Known Incorrect Statements About Eb5 Immigrant Investor Program

This implies that the new commercial venture (or its wholly owned subsidiaries) should itself be the employer of the certifying staff members. For a brand-new business located within a local center, the new business can directly or indirectly create the full time positions. As much as 90% of the task creation demand for local facility financiers may be fulfilled using indirect work.Indirect work are held outside of the brand-new company but are produced as an outcome of the new company. EB5 Immigrant Investor Program. In the instance of a distressed service, the EB-5 financier might depend on task upkeep. The capitalist must show that the number of existing workers is, or will certainly be, no much less than the pre-investment degree for a duration of at the very least 2 years

The loss for this period must be at least 20% of the struggling business' net well worth prior to the loss. When identifying whether the distressed business has remained in existence for two years, USCIS will certainly think about followers in passion to the struggling organization when evaluating whether they have actually been in presence for the very same period of time as business they was successful.

Top Guidelines Of Eb5 Immigrant Investor Program

Jobs that are intermittent, short-lived, seasonal, or short-term do not qualify as long-term full-time work. Work that are expected to last at the very least 2 years are typically not considered periodic, momentary, seasonal, or transient. Resources suggests money and all actual, personal, or mixed substantial assets owned and controlled by the immigrant financier.

In a normal situation, local facilities manage conformity with the EB-5 program, while developers handle job administration and construction. With concurrent adjustment filings, capitalists can use for job and travel allows upon filing.

What Does Eb5 Immigrant Investor Program Mean?

As long as a kid apply for change of standing prior to turning 21, they will be shielded from aging out under the Youngster Status Security Act (CSPA). Also if visas ultimately come to be not available while the primary investor's I-526E petition is pending, USCIS will certainly refine the youngster's modification application once the concern date becomes present.

Aspects include the youngster's age when the moms and dad submitted the I-526E request, the period the request was pending, when a visa appears, and when the youngster availed themselves of the visa (EB5 Immigrant Investor Program). Financiers abroad who have actually been rejected nonimmigrant visas due to regarded immigrant intent, who are incapable to find business ready to sponsor them for work visas, or that do not get family-based visas might still be eligible for long-term home through the EB-5 program

30, 2018, in the instance of Zhang v. USCIS, No. 15-cv-995, the United State District Court for the Area of Columbia certified a class that consists of anyone that has a Form I-526, Immigrant Application by Alien Investor, that was or will certainly be denied on the single basis of investing loan proceeds that were not safeguarded by their very own properties.

Some Known Details About Eb5 Immigrant Investor Program

In May 2019, we sent letters to all petitioners whose applications we denied and to petitioners that withdrew their I-526 petitions. We wanted to ensure to notify all possible course participants. If you received this notification and do not think that you are a potential course member, please disregard the letter; you do not need to take any kind of further activity.

With this choice, the court licensed the class, and we are reopening and adjudicating course participant requests regular with the court's choice. The main objective for providing the requested details in your email is to determine your eligibility as a course member and, if so, to make a determination whether to reassess your Type I-526 petition.

Eb5 Immigrant Investor Program Fundamentals Explained

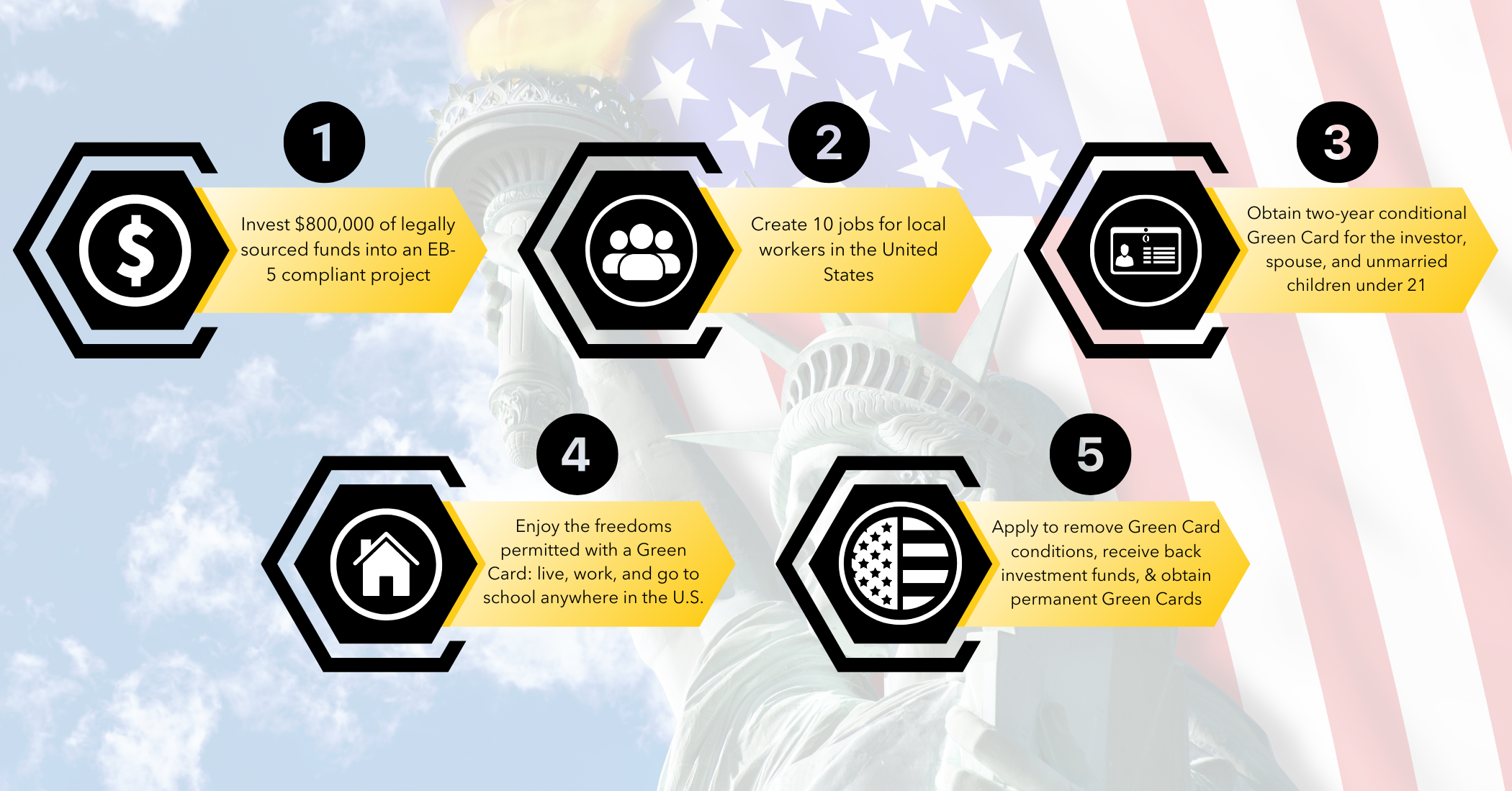

This Conditional residency will certainly be legitimate for two years. Prior to the end of the two years the investor need to file a second request with Immigration to get rid of the conditions. In the request the investor must reveal that the investment venture is still readily active and has the required 10 (10) employees.

When a capitalist ends up being an Irreversible homeowner the financier might market or sell off component or all of the investment venture. Qualifying Investors Any type of individual, regardless of citizenship might receive the EB-5 visa. Certifying investors must, nevertheless, be real persons and not firms, although the financial investment needs to be made with a corporation.

The Only Guide for Eb5 Immigrant Investor Program

A capitalist can also develop a brand-new venture by expanding an existing company. To qualify the expansion must result in a boost of a minimum of 40 percent in the total assets of the service or in the number of employees of business. Administration of the Venture by the Capitalist An EB-5 candidate need to be included in the management of the new industrial business.

The possessions of the investment venture upon which the petition is based might not used to secure any one of the bankruptcy. Work Production To certify for EB-5 condition, a financial investment web link typically must create full time employment for at the very least 10 U.S. citizens, legal long-term residents, or various other immigrants lawfully accredited to be utilized in the USA.

Households and individuals who seek to relocate to the USA on a permanent basis can get the EB-5 Immigrant Capitalist Program. The USA Citizenship and Immigration Provider (U.S.C.I.S.) laid out different requirements to obtain permanent residency with the EB-5 visa program. The requirements can be summarized as: The investor needs to fulfill funding investment amount requirements; it is usually required to make either a $800,000 or $1,050,000 capital expense amount right into an U.S. As soon as the opportunity has actually been determined, the capitalist should make the financial investment and submit an I-526 application to the U.S. Citizenship and Immigration Solutions (USCIS). This application needs to consist of evidence of the investment, such as financial institution statements, purchase contracts, and business plans. The USCIS will review the I-526 petition and either authorize it or demand added evidence.